Collateral Free Business Loan For Startup – 2022-06-17 00:00:00 2023-02-01 00:00:00 https:///r/start-up-business-small-business-loans/ Starting a Business English Getting a small business loan can be opened to help your business grow. This guide will help you understand the financing options available and what information you need to prepare to apply for a loan. https:///oidam/intuit/sbseg/en_us/blog/graphic/small-business-loan-header-image-us-en.jpg https://https:///r/starting-a-business/small -Business-loan / How to get a small business loan: guide and tips |

If your existing or newly established small business needs working capital, but securing investors, personal loans or small business donations is not an option, a business loan may be your best option.

Collateral Free Business Loan For Startup

Business financing can be a long and confusing process. But rest assured—with the following road map, you’ll understand the process and information you’ll need to gather as you prepare to apply for a business loan.

Startup Business Loans For Bad Credit (2023)

In this article, you’ll learn how to get a small business loan, the different types you may qualify for, and how to choose the one that’s right for you.

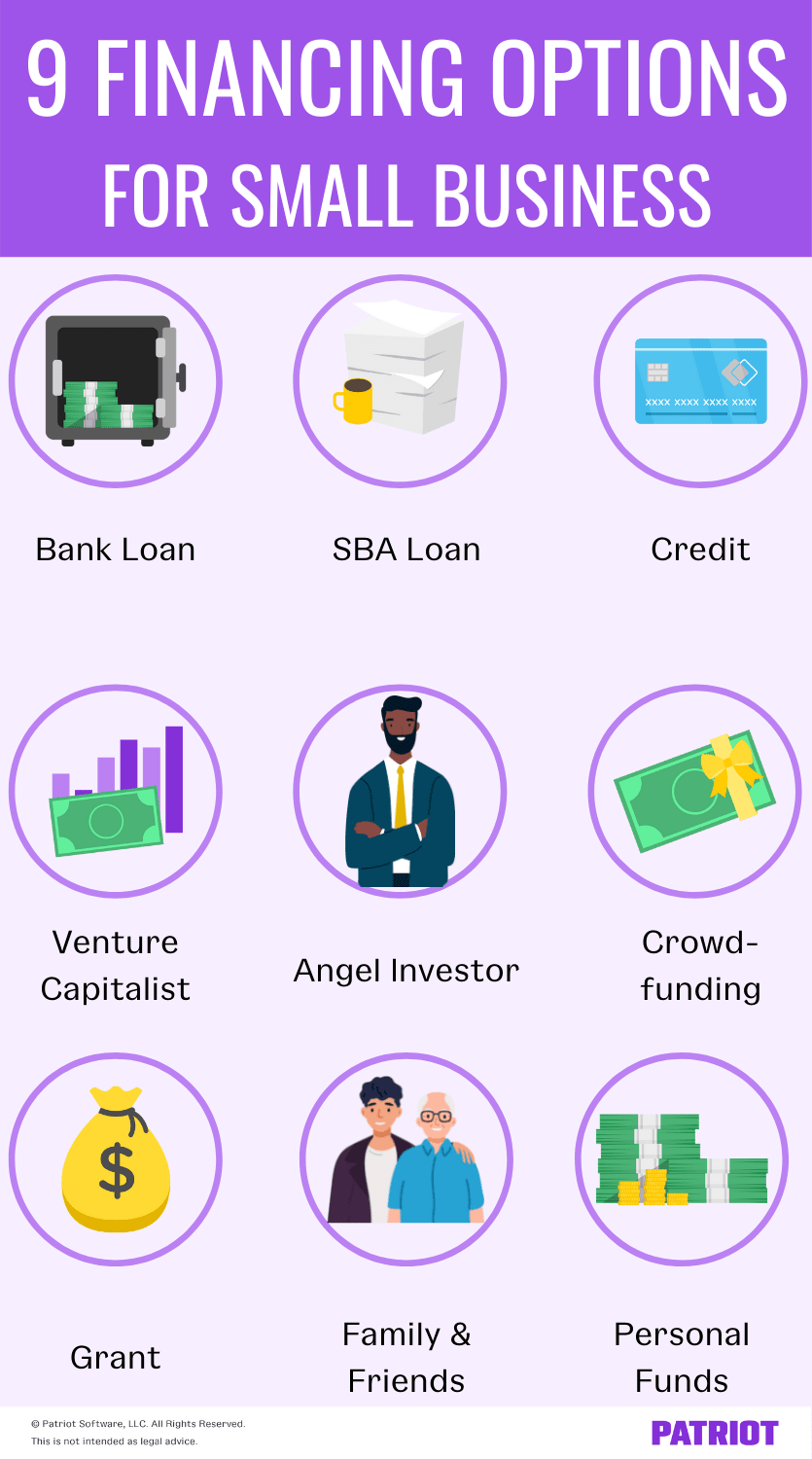

There are many types of small business loans, including small business loans, traditional loans, business lines, payday loans, and specialty loans. Explore the different options below to see what is the best loan for your small business.

SBA loans are backed by small business lenders but are guaranteed by the US federal government. The most common loan of this type is the SBA 7(a) loan. Because the federal government supports the loan on behalf of your business, your small business is more likely to get approved than if you went directly to lenders. SBA loans range from $500 to $5.5 million.

You can apply for traditional business loans through direct lending banks and financial institutions. Bank loan rates vary based on traditional lender requirements, the size of the lender, and the industry, size and history of your business.

How To Get A Small Business Loan For A Startup / New Business

A business line of credit is similar to a loan in that you apply for a fixed amount of money. Once approved, you can access the funds. Unlike a loan, however, a business line of credit allows you to take out only the amount of money you need, and you only pay interest on that amount.

While not technically considered a business loan, using unpaid invoices owed to your business can be a way to get short-term financing when you need cash. There are two options for using your receipts to get financing.

Billing is a business practice where your business sells invoices to a third-party company (a factoring company). The manufacturing company will immediately pay your business the maximum amount of the invoice (usually 80%-90%).

Your customer then pays the invoice amount to the manufacturing company according to the payment terms (for example, 30 days, 45 days or 60 days). Once your customer has paid the invoice amount from the fabricating company, the fabricating company will pay the balance of the invoice.

A Comprehensive Guide To Small Business Grants For Canadian And Us Small Businesses — The Branded Agency

Similar to invoice financing, but where your business takes ownership of your invoices, but use them as collateral for financing. In an installment finance agreement, the lender may offer you finance at the invoice amount you support, minus any fees the lender pays. It offers the option to receive prepaid invoices through invoices so you can see your money faster and get the money you need to grow your business.

Certain small business loan programs support specific groups or causes. For example, the SBA’s Office of Women Business Ownership and Women’s Business Centers help women business owners get loans. USDA helps small business owners in rural areas get loans. The Accion Opportunity Fund provides loans to entrepreneurs of color, women and immigrants.

Before you apply for a small business loan, there are some things to consider to make sure you’re prepared. Here are some eligibility requirements that most small business loans require:

A credit history is a record of a borrower’s debt payments. Just like a personal credit score, your business also has a credit score. Normally, lenders review your business credit history, but if you’re a startup, lenders may want your personal credit history.

How To Get A Business Government Loan For Startup?

Make sure you understand what your personal responsibilities are in this case if a lender asks to check your personal credit history. If you sign a business loan, you are personally responsible for the debt your business incurs.

Typically, business loan providers prefer a credit score of 680 and above. If you happen to fall on the lower end of the spectrum, you may want other strong business credentials as evidence, such as high annual revenue and years of business establishment.

Your business history is a brief description and financial record of your business. Prepare financial and bank statements for at least five years if you have been in business that long. Lenders look at your history to predict the future. You want answers to questions like:

Your pitch to creditors should specifically address how you will apply the money and how your business will repay the loan.

How To Get A Small Business Loan Without Collateral?

For example, you want to hear that they hire software developers with loan money and the applications the developers build start generating revenue within six months of being hired. They don’t care about the software itself – it just allows the software to pay you interest for the life of your loan.

Finally, lenders need a clear understanding of your business collateral. If you default on your loan, the lender needs to know how to repay the loan.

Since business assets such as equipment, inventory, and accounts receivable all change in value as you operate your business, most lenders require multiple types of collateral to complete a loan.

If you do not have collateral, the lender may look for another borrower with sufficient collateral to lend or guarantee the loan. Lenders need to see if your business has the assets to secure the loan, so make sure you understand the collateral requirements.

Small Business Funding Options: How To Secure A Startup

Getting a loan for your small business may seem difficult at first, but it will be much easier if you are prepared to go through the application process. Here’s how to get a small business loan in six easy steps.

It may seem obvious that you need to determine how much money your business needs before you start looking for a loan, but you shouldn’t skip this step for three reasons:

Before jumping into debt, consider your other options. Is your business better off adding an additional owner instead of equity capital?

Instead of taking out a loan for more employees, is it possible to outsource the work to a freelancer and avoid the need for a loan? In other words, make sure that a loan is right for your business before committing to a debt settlement strategy.

Sources Of Microloans In Canada: Startup Money

As mentioned, there are many loan options for your business, but how do you decide which one is the right fit? Evaluate each loan to determine its suitability for your business and consider the following factors:

Once you have settled on the type of loan for your business, contact the relevant lenders. Think of your business as a customer in this process. Shop around. Play one lender against another and find the best deal possible.

Because lenders make their money on interest when it comes to small business financing, they may not offer you the best rate at the outset. Don’t be offended by this. He defended them. Let the lender know that you are shopping for their rates and terms against competitors.

A word of caution when shopping lenders: If you authorize a lender to check your credit score, the check will appear on your credit report. You don’t want your credit score to be checked too many times in a short period of time. Get as many details as possible from the lender before you give them permission to check your credit score.

How To Get Collateral Free Business Loans Easily

Once you’ve narrowed down your list of lenders, make sure you understand their criteria before applying. For example, most lenders require collateral to secure the loan.

You provide your business collateral as a backup in the legal documents that you fill out to finalize the loan. If you do not pay the loan, the lender has the right to take your collateral, then sell the collateral to pay off the loan.

If a lender is not satisfied with your business collateral, you may want to look for a lender with better collateral. In this case, you want to find a transferor before the loan documents are ready to be signed.

Understand collateral fees and any other loan requirements early in the process. Take the time to decide what risks you are willing to take to secure your loan.

Top Business Loans For Startups Unsecured No Collateral Needed

The documents required to secure a loan vary from lender to lender and depend on your business history. Some of these documents include:

If your business has enough cash to cover the entire loan, you probably don’t need much more than a balance sheet and some recent financials. However, the fact that you are considering a loan, maybe